Barclays has become the first high street UK bank to allow its customers to voluntarily block transactions to gambling services as well as other services such as premium rate phone lines and various categories of retailers.

Customers can decide what categories of transactions they would like to disable through the Barclays mobile app, over the phone, or in person at a local Barclays branch. Once a category is disabled, any payment the customer tries to make to a retailer in that category will be declined automatically.

Barclays worked with the Money Advice Trust, a debt charity, and information provided by the Money and Mental Health Policy Institute to design and implement this new option for their customers. The company says that they believe it will help all of their customers take control of their own spending but should prove especially beneficial for people with addiction or mental health issues and those who rely on a caregiver or guardian to take care of their finances.

[If You Think You Might Have A Gambling Problem, Please See Our List Of Organizations That Can Help]

Including app-based banks Monzo and Starling, Barclays is the third bank to allow consumers to block gambling transactions. With Monzo, requests to lift the restrictions take 48 hours to complete. With Starling and Barclays, however, customers can reverse their decision immediately.

Martin Lewis, founder of the Money and Mental Health Policy Institute said, “Mental health and debt is a marriage made in hell. Many with mental health issues struggle to control their spending – whether through gambling, shopping or premium phone lines – and I commonly hear from people with thousands of pounds of debt as a result.

“I want to applaud Barclays for being the first major bank to sit up, take note and act. I believe it will make a real difference to people’s lives and I hope the other banks will follow suit.”

Some are saying that a self-imposed restriction that can be lifted as easily as it’s enacted makes little sense and won’t really do anything to stop problematic compulsive behavior. Addressing this point through a Facebook post, Lewis said, “Making something more difficult to do slows people down, and gives time to consider. This is important when you’re dealing with impulse control.

“It has long been used in other sectors, eg, blocking pharmacies selling people more than 32 paracetamols makes it more difficult for someone to buy enough to overdose. Of course people can go to more than one store, but the conscious act of having to do that because people are trying to prevent it is a barrier.

“With blocking gambling transactions (or premium phone lines as Barclays also allows) on a card, the fact you chose to do it, adds an emotional significance to working around it – ie, you’ve committed to not gambling, and now you’re changing.

“It isn’t perfect. It won’t stop everything, yet hopefully, it is another tool to help people control themselves.”

How To Disable Gambling Transactions In The Barclays App

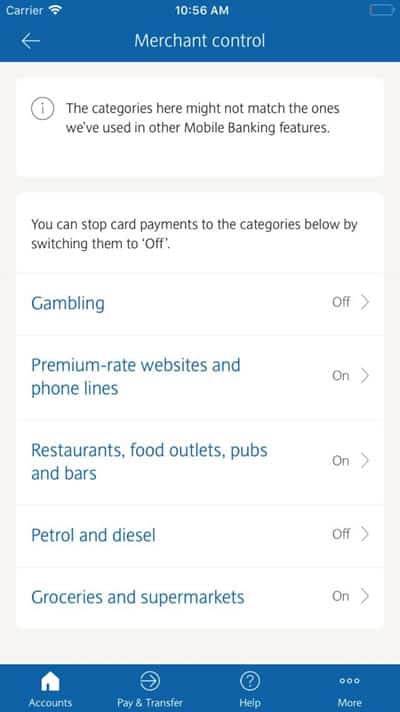

Using research and advice supplied by their collaborators, Barclays identified five retail categories where customers indicated they wanted extra help managing their financial decisions. Those five categories are:

- Supermarkets and groceries.

- Restaurants, pubs, and bars.

- Petrol and diesel.

- Gambling including both online and in betting shops.

- Premium rate phone lines including:

- 0870 numbers (sales calls).

- 09 numbers (live tv voting, competitions, adult).

- 118 numbers including directory inquiries.

It’s important to note that in the case of premium phone lines, the bank can only block purchases from being made over these services, not telephone calls to the numbers themselves.

It’s important to note that in the case of premium phone lines, the bank can only block purchases from being made over these services, not telephone calls to the numbers themselves.

Disabling or re-enabling transactions for any or all of the above categories is as simple as opening the Barclays mobile app and navigating to the Merchant Control system which is pictured on the left.

Also, as was mentioned above, customers can call over the phone or go into a local Barclays branch to disable or re-enable transactions.

Speaking about this new feature, Barclays managing director Catherine McGrath said, “We are always looking for new ways to support our customers and make it easier for them to manage their finances.

“We work with a range of advisers and partners, as well as consulting with our customers, to identify how our customers’ needs are changing and what works for them.

“This new control feature is the latest new service that we have introduced in the Barclays mobile banking app that aims to give all of our customers a better way to manage their money in a simple, secure and effective way.”

Just how effective this new feature proves to be remains to be seen. The fact that a major bank like Barclays has implemented this feature at all, though, is definitely a step forward. Hopefully, other financial organizations will follow in their footsteps. Nothing is going to be perfect, but any tool that helps those with a problem to help themselves is welcome.